2023 paycheck calculator

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Va Disability Pay Schedule 2022 Update Hill Ponton P A

It will be updated with 2023 tax year data as soon the data is available from the IRS.

. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator. Calculate Location-Adjusted Pay With Our GS Pay Calculator.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. This normally occurs in the last few days of December each year. SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay.

Kansas paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. Calculates Federal FICA Medicare and withholding taxes for all 50 states. Start the TAXstimator Then select your IRS Tax Return Filing Status.

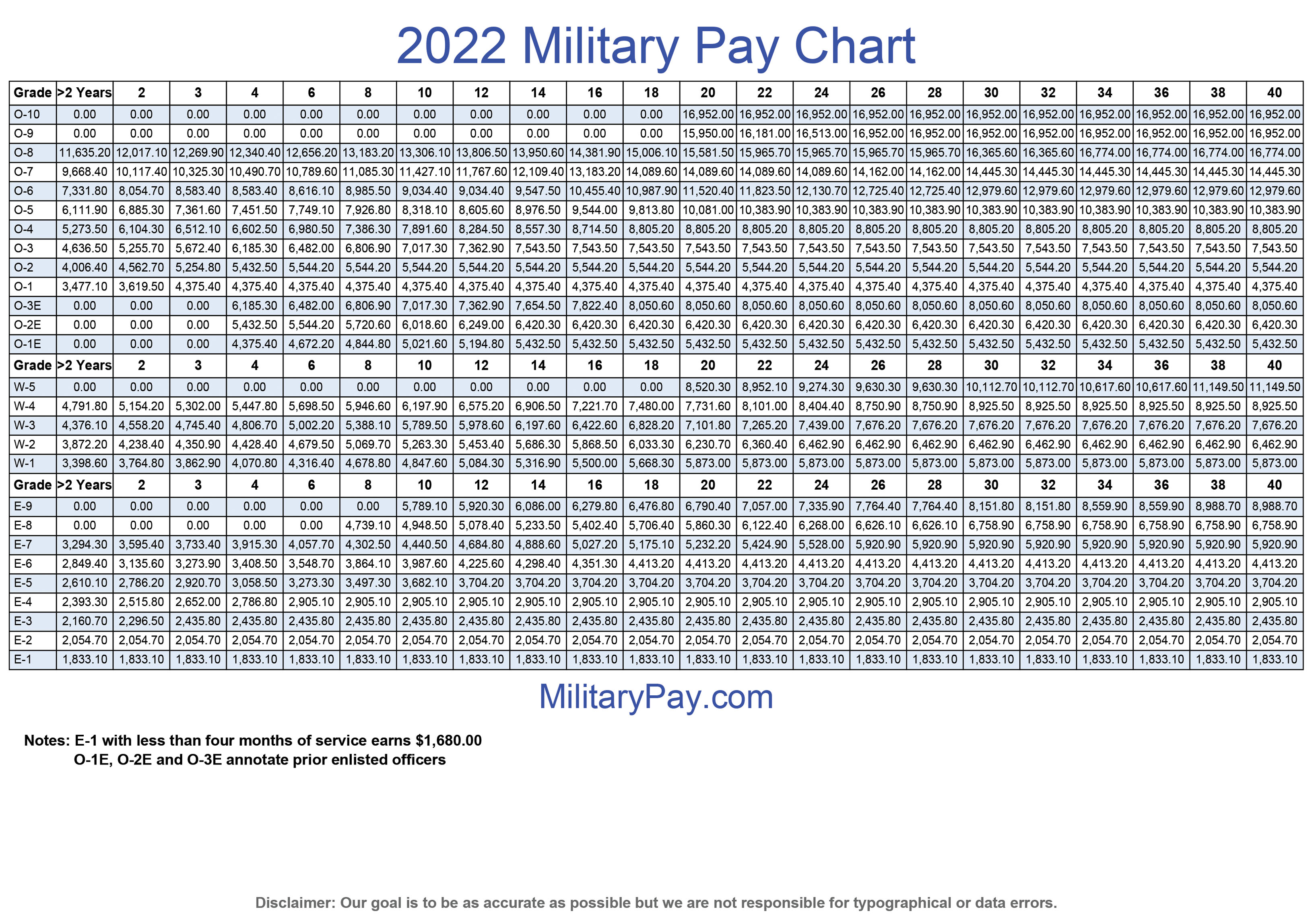

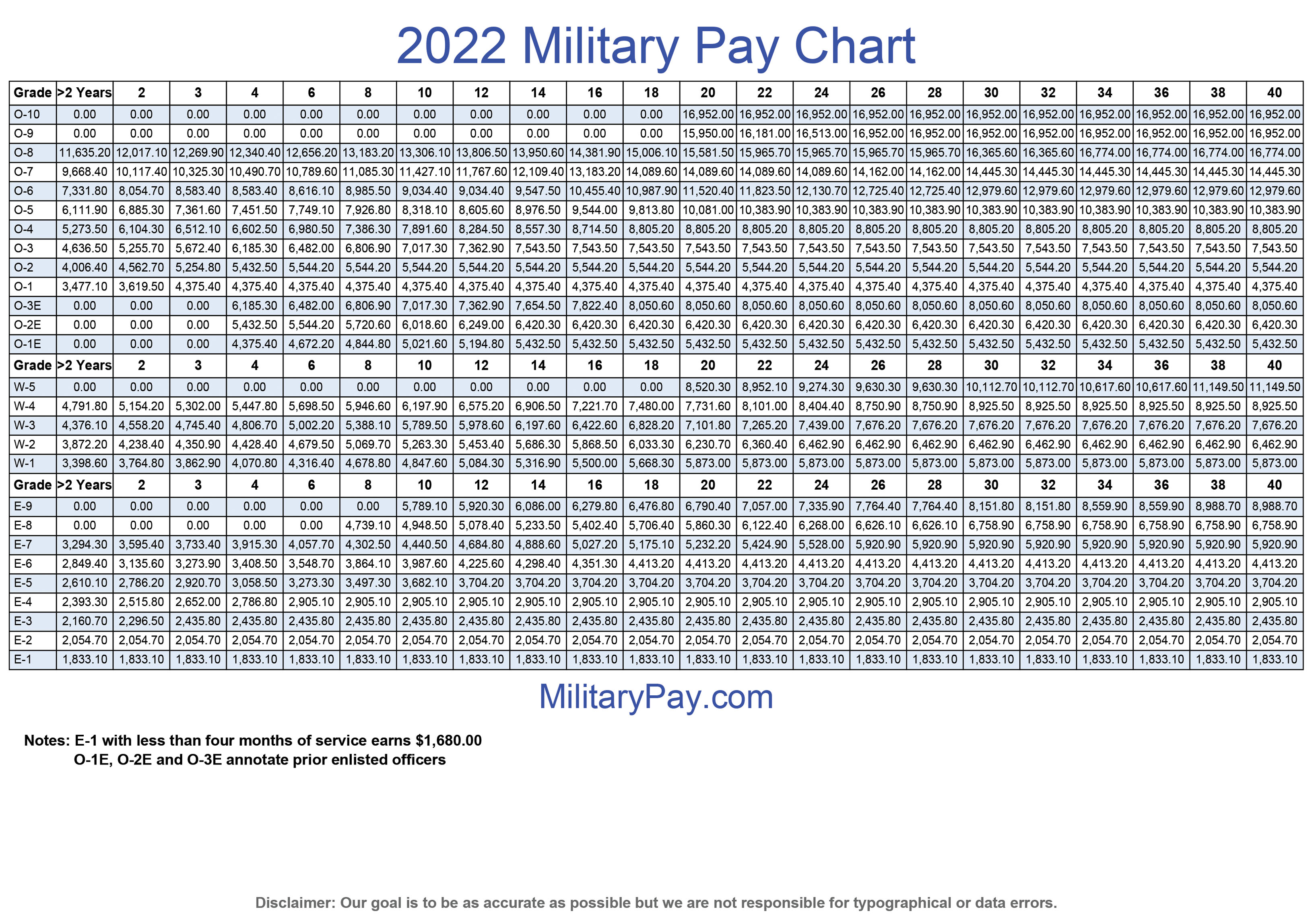

Pay dates are the last work day on or before the. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Military members may receive a 46 pay increase in 2023 according to a defense budget draft.

To view the GS Pay Scale table for the current year or other historical years choose any year from the list above. Employees must also enter their federal and state tax filing statuses. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

The official 2023 pay table will be published here as soon as the data becomes available. As well as ways to pay for school such as scholarships for military and veterans. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

The federal tax you are going to pay varies according to the information you provide on the Form W-4. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. The 2020 GS Pay Scale tables will be published on this page after the White House issues an executive order to the Office of Personnel Management.

Employers can enter an employees W-4 information pay rate and deductions or benefits into the calculator. This free easy to use payroll calculator will calculate your take home pay. How to calculate taxes taken out of a paycheck.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Payroll Guidelines for 2022-2023. Try out the take-home calculator choose the 202223 tax year and see how it affects your take-home pay.

Calculate Your Post 911 Monthly Housing Rate for 20222023 School Year. 75610 NOTES FOR OFFICER 2 CANDIDATES ABOVE. It will confirm the deductions you include on your.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Begin tax planning using the 2023 Return Calculator below. See IRSgov for details.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. An updated look at the Boston Red Sox 2023 payroll table including base pay bonuses options tax allocations. Get a head start on your next return.

FAQ Blog Calculators Students Logbook Contact LOGIN. Basic pay for an O-7 to O-10 is limited by Level II of the Executive Schedule in effect during Calendar Year 2023 which is 0000000. This calculator is intended for use by US.

You can use the calculator to determine the Post 911 GI Bill BAH rate for the 20222023 school year by doing the following. On the other hand if you make more than 200000 annually you will pay 09 additional Medicare tax for the balance exceeding 200000. An updated look at the Boston Red Sox 2023 payroll table including base pay bonuses options tax allocations.

Use this simplified payroll deductions calculator to help you determine your net paycheck. So your big Texas paycheck may take a hit when your property taxes come due. Switch to California hourly calculator.

Free ITIN application services available only at participating HR Block offices and applies only when completing an original federal tax return prior or current. Supports hourly salary income and multiple pay frequencies. Contractors - LTD Company v Umbrella.

Payroll Table 2022-2023 Contracts Active Multi-Year Salaries Free Agents 2022. All Services Backed by Tax Guarantee. Dare To CompareIT This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Ad Payroll So Easy You Can Set It Up Run It Yourself. We can also assist you through your transition with certificate.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. It can also be used to help fill steps 3 and 4 of a W-4 form. Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents Income Deductions Other Credits Paid Taxes.

The federal employee pay increase contains an across-the-board 26 pay raise plus an average 05 increase in locality pay. Answer a simple question or complete an alternate activity to dismiss the survey box and submit your tax calculator results. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates.

Sign up for a free Taxpert account and e-file your returns each year they are due. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Sage Income Tax Calculator.

Discover ADP Payroll Benefits Insurance Time Talent. On top of a powerful payroll calculator. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Basic pay for O-6 and below is limited by Level V of the Executive Schedule in effect during Calendar Year 2023 which is 000000.

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Ts Prc Calculator 2023 For Teachers Employee Salary With New Fitment

Payscale S Salary Budget Survey Is Open For Participation For 2022 2023 Payscale

2023 Va Disability Pay Dates The Insider S Guide Va Claims Insider

General Schedule Gs Base Pay Scale For 2022

Salary Tax Calculator 2022 23 Pakistan Income Tax Slabs 2022 23

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Military Pay Charts 1949 To 2023 Plus Estimated To 2050

Calculator And Estimator For 2023 Returns W 4 During 2022

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Payroll Calendar Los Angeles City Controller Ron Galperin

Calculator And Estimator For 2023 Returns W 4 During 2022

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

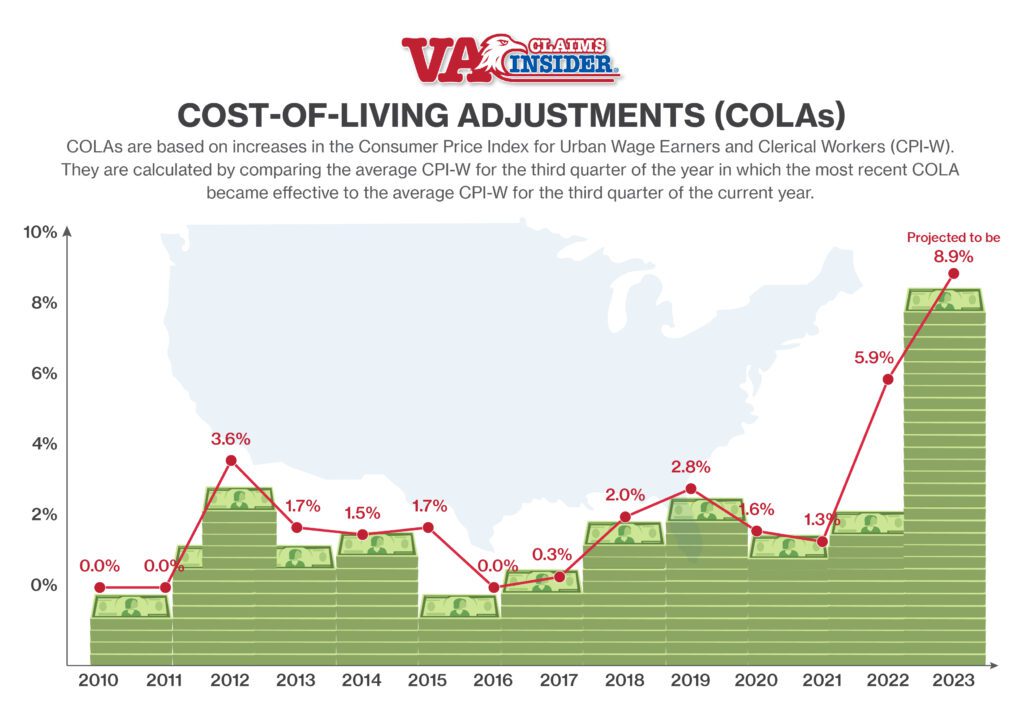

Will There Be A 2023 Cola Increase Massive 8 9 Social Security Increase Could Be Coming Va Claims Insider

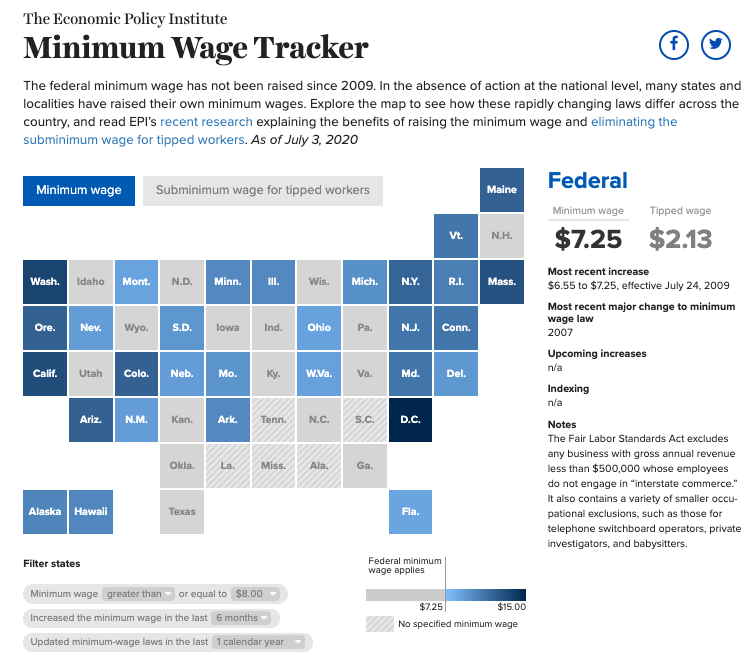

Minimum Wage Tracker Economic Policy Institute

Pay Parity Calculating Your Pay Ece Voice

2023 Va Disability Rates Projected Massive 8 9 Cola Increase Could Be Coming Va Claims Insider